2017 Highlights

We are Ascential – the global, specialist information company that enables smart decision-making for business.

In an increasingly complex, digitally driven world, we help our clients understand what’s important and how to act on it – today, and in the future.

Through our business-critical intelligence, world-class events and advice, we empower the world’s most ambitious brands to find their focus and improve performance, particularly in the digital economy. From finance to fashion, eCommerce to economic forecasting, we anticipate trends and connect people to market-leading, sector specific, expertise – helping customers to overcome their commercial challenges and unlock value.

When you can see the future, it’s easier to get there first – join us in staying a step ahead and ‘unlock the future’.

CONSUMER VALUE CHAIN

EMPOWERING

BRANDS

80% of our revenue comes from brands that serve the consumer products and services industries globally across three main areas of capability for our customers.

Product Design

Unlock trends that enable you to design for

tomorrow's consumer, today

Marketing

Unlock insight and connections for better decision making and more targeted campaigns

Sales

Unlock data, analytics and industry-specific platforms to maximise distribution opportunities and drive growth

Marketing

Sales

Chief executive's review

“We have delivered good results whilst accelerating product innovation and growing our market leadership position.”

Duncan Painter Chief Executive OfficerChief executive's review

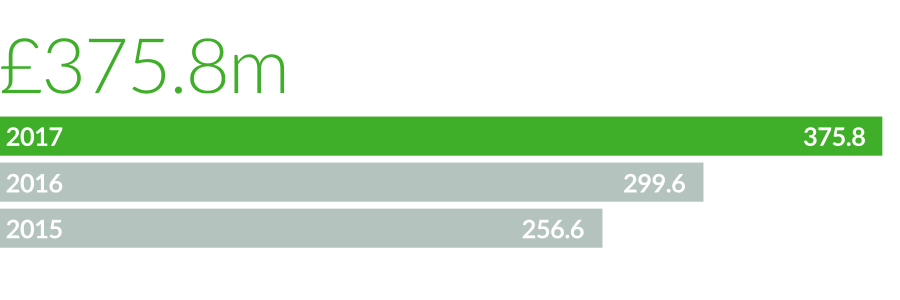

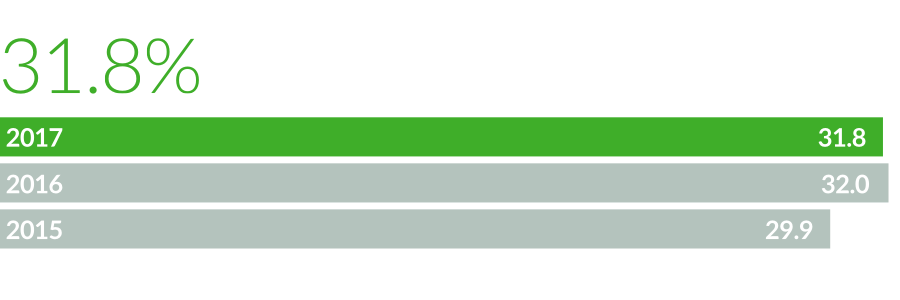

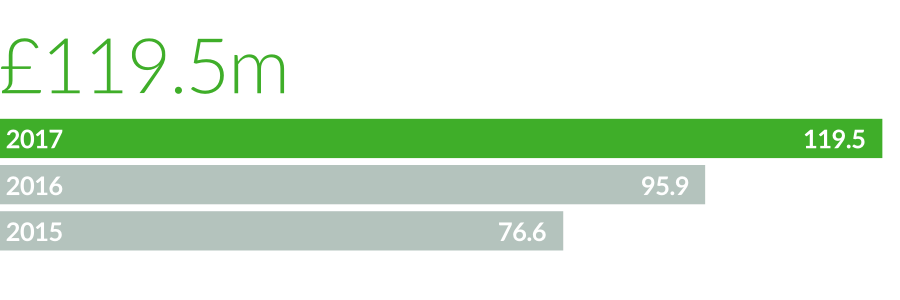

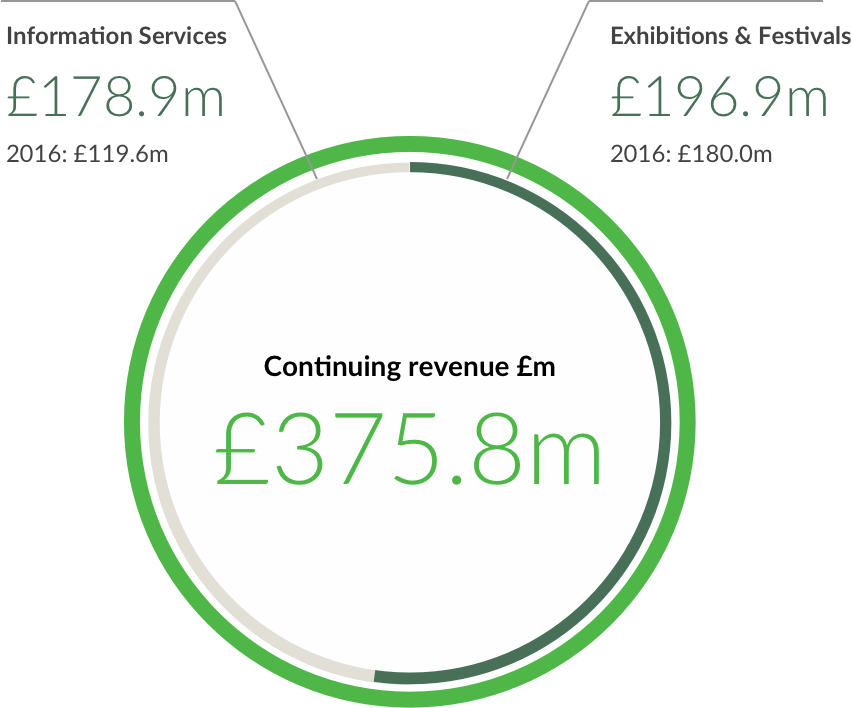

The 2017 year was one of effective execution resulting in Organic revenue growth of 6.4% while maintaining strong Adjusted EBITDA margins of 31.8%. Revenue was £375.8m (2016: £299.6m), a reported growth of 25%.

All of our execution continues to centre on our stated strategy, which can be summarised in three goals:

- To be a leading, specialist, global information company that enables customers to excel in the digital economy in Product Design, Marketing and Sales.

- To accelerate the organic growth of our revenues and optimise margins and profits.

- Through the application of a tightly focused capital allocation process, to achieve our goals and maximise value creation for our shareholders.

With these three goals as our guide, we have made a great deal of operational progress this year, sharpening our portfolio, enhancing our product offering and acquiring exciting, high-growth businesses that fit with our ambitions. Examples of that progress include the:

Each of these achievements has positioned us well to increase our growth rate in revenue and profit in 2018. We are pleased that our teams have been able to continue to deliver on the ambition we set out at the time of our IPO to become a more focused, faster growing company, with a greater number of satisfied customers allowing us to generate higher levels of returns for our shareholders.

The majority of our customers are consumer product and services companies (or companies in their supply chain), who operate globally. We have built in recent years a reputation for enabling these customers to succeed in the digital economy. The rapid digitisation of commerce – and of business more generally – is one of the highest priorities for our customers and, in many cases, their greatest challenge. The information and capabilities we provide to customers in facing this challenge are increasingly valued, differentiated, trusted – and pivotal to our future growth. Furthermore, it is becoming increasingly apparent that we are at our best when providing information, intelligence and insight that helps our customers evolve their approach to Product Design, Marketing and Sales for success in this new digital context.

Our top 10 brands deliver over 80% of our revenue and 90% of our organic growth. By continuing to optimise both the focus of our teams and the allocation of capital to our most important brands, we have grown well in 2017. This growth allows us to continue to simplify and optimise our business model to serve both our customers’ and shareholders’ needs.

In 2017 we increased the number of companies we do business with, whilst also diversifying the number of products we provide to our most significant customers. Growing our customer volumes, the number of products they buy and therefore the amount they pay us, plus their willingness to expand their relationship more broadly across their companies gives us confidence that our strategy is working.

Really listening to customers is one of the most important skills we ask our teams to employ and is a skill we continually hone. Retaining customers is at the centre of our growth model.

We have created a culture where our teams are passionate about how to improve the information quality and relevance we provide plus how we can make it easier to consume and action. At the heart of this is an environment where all teams are encouraged to discuss, share and take actions to first understand and then address why customers leave our services. Going through monthly reviews of lost customers, understanding the reasons in depth and being open about how we will improve our products and services is at the tough end of our success. It is also at the heart of it. Without learning from our most difficult customer situations, we could easily be focusing on the wrong priorities. Creating an environment where people recognise the importance of these conversations and are willing to actively engage and learn from the feedback is an essential foundation.

Of course, our people are very proud of the products and services we produce. However, by keeping a laser focus on retention, it ensures we remain grounded and recognise the need for continual improvement. Our success will only continue by constantly improving the information we deliver through digital subscriptions, live events and expert advice. In an increasingly complex, digitally driven world, these products must help clients digest what is important to their business and how to act on it now and in the future. Our markets move rapidly and in the digital age this is only accelerating. Our primary task is to continue to configure our business to keep ahead of this change.

In 2017, we made investments in capabilities and teams across our business to ensure we can keep ahead of the critical needs of our customers including:

- expansion of our customer insight teams and digital analysis capabilities;

- expansion of our digital product creation and development teams; and

- upgrade of our digital marketing and customer engagement capabilities and our eCommerce teams.

We funded these investments by accepting we would deliver a lower organic EBITDA growth rate for one year of 3%. We have not made these investments lightly and have already seen, through the immediate gains and capabilities created, how they will enable improved growth rates for 2018 and beyond.

The best example of this is the launch of our new Avista product within Groundsure which grew revenues by 13% in a particularly tough market. This new product format, built by our newly created digital product team, has step changed our results in Groundsure. Not only did the team deliver the product to a very high quality within five months, but the impact of its design and ease of use for our customers meant that we could drive market share while also improving our yield for this new, high value, product. The design approach taken means that we can gain further traction from this investment in 2018 by building the next generation of our volume product range, leveraging the efficiency of the Avista environment to drive revenue growth while also streamlining our own operation.

We are now applying more widely the skills of these high quality teams to improve the performance of our most important brands.

We believe that to maximise returns for our shareholders, our focus as a business is best targeted at brands that support customer success in the digital economy. To ensure that our capital allocation is aligned to that opportunity we will be undertaking a strategic review of our exhibitions business (comprising the Spring and Autumn Fair, Bett, CWIEME, Pure, Glee and BVE brands which generated £78m of revenue in 2017). These brands are all number one in their markets and are of a size and scale that allows us to consider a variety of options to maximise their future value and enhance our overall organic growth rates.

The year ahead presents great opportunity for Ascential. Economic markets, particularly for our most important brands, remain strong particularly with our focus on supporting customer success in the digital economy. Many of our clients currently achieve less than 20% of their total sales through digital channels. They themselves recognise the need to move faster to drive this critical transition and, with our developments in the last 18 months, we are now very well positioned to assist them to unlock this future.

As we focus on our strategic objectives, it will mean a further year of change for the company. We will continue to assess the balance of the brands and product types in our company and how we can optimise our capital allocation going forward and we will continue to take proactive moves to achieve this. We have achieved a significant transition of our business over the last five years, particularly since our IPO. Nevertheless the urgency of continued and accelerated transition that our customers face to remain relevant remains just as critical for us.

I have great confidence in the capabilities and skills of the Ascential team, our valued relationships with our customers and the initiatives we have underway to continue to deliver strongly for our customers and our shareholders.

While still early in 2018, we are encouraged by the current level of forward bookings. Our achievements in 2017 have positioned us well to increase our growth rate in revenue and profit in 2018 and the Board is confident about our prospects for continued success.

Really listening to our customers is one of the most important skills we ask our team to employ.

Chief Executive's review (PDF)Our values and leadership beliefs

Forward thinking

We think big and see the bigger picture to help our customers translate insight into advantage

Leadership beliefs Focus – we prioritise and keep things simpleFacts – we use data and insight to inform our work

Empathy – we can be relied upon for fairness and consideration

Challenging

We are thought-provoking and persuasive – always searching for a better way to get things done

Leadership beliefs Creativity – we are smart, pro-active innovatorsTransparency – we tell it as it is

Openness – we insist on honesty, integrity and openness

Transformative

We are visionary and confident – making changes happen

Leadership beliefs All-in – we have a clear focus on outcomeNo silos – we are one team

Clients

Unlocking the answer to our clients’ most complex business challenges

THE ADVANTAGE FOR OUR CLIENTSOur intelligence and insights ensure our clients’ businesses thrive in the digital age, keeping them ahead of their competitors while driving innovation through world-class networking events and opportunities

Investors

Unlocking a strong investment opportunity for our stakeholders

THE ADVANTAGE FOR OUR INVESTORSOur market leading brands evolve with customer demand, unlocking a dependable and exciting investment proposition built on strong growth, good profitability and disciplined use of capital

Employees

Unlocking our employees’ skills and potential in a business that’s always evolving

THE ADVANTAGE FOR OUR EMPLOYEESWe nurture our employee talent, unlocking hidden skills through unique learning and development opportunities and creating entrepreneurial environments and cross-brand opportunities

Our Strategic priorities

Driving

Growth

In 2018 we will continue to prioritise our market leading brands, while simplifying the way we work across the organisation to drive further efficiency and synergies.

- Market Leading

-

Accelerate Organic

Growth - Capital Allocation

Our Priorities

Be a market leading information company, enabling our customers to excel in the digital economy in product design, marketing and sales.

Goals for 2018

To establish Money20/20 as the leading financial technology payments event platform across the four biggest markets of the United States, China, Europe and South-East Asia.

To create the leading enterprise insight platform for market planning, digital shelf, market share, promotion, content and trade research worldwide.

Our Priorities

Accelerate the organic growth of our revenues and optimise margins and profits.

Goals for 2018

To accelerate the growth of the WGSN products launched over the last 18 months, establishing leadership across the new segments of Insight and Coloro.

To continue the evolution of the Cannes Lions platform to ensure the marketing industry has a consistent measure of creativity across all digital economies and new media formats, while accelerating our own digital propositions to further establish the global Cannes Lions benchmark.

To maintain our market leading customer retention levels across our most important brands.

Our Priorities

Apply a tightly focused capital allocation process, to achieve our goals and to maximise value creation for our shareholders.

Goals for 2018

To optimise our capital allocation and balance sheet to enable us to achieve our goals and to continue to simplify the Company.

downloads